December isn’t just the end of the year.

It’s the last real window you have to intentionally influence what your 2025 financial picture looks like.

Once the calendar flips, most strategic options are gone. Deadlines pass. Elections are locked. And many business owners realize—too late—that a few intentional moves could’ve saved them tens of thousands of dollars.

This isn’t about scrambling or doing more.

It’s about reviewing the right things, at the right time, with clarity.

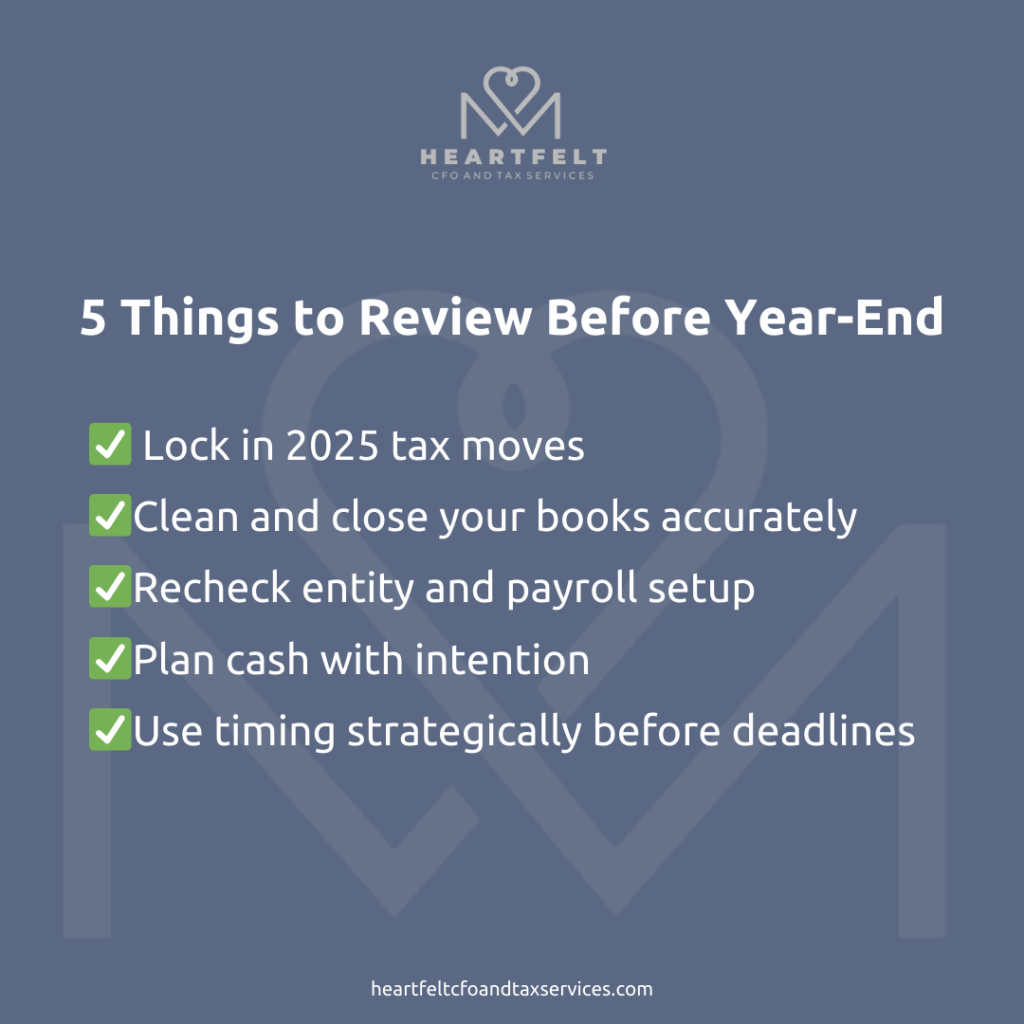

Below are five areas worth revisiting before year-end, plus the practical steps that actually make a difference.

1. Lock in 2025 Tax Moves Before They Expire

Tax planning doesn’t happen in April.

By then, the decisions that mattered were already made—or missed.

December is when you still have control over things like:

-

Retirement contributions

-

Timing income and expenses

-

Owner bonuses

-

Equipment or asset purchases

Miss these windows, and the outcome is simple: you pay more than you needed to.

Steps to Take Now

-

Review your year-to-date income and projected final numbers

-

Confirm retirement contribution limits and eligibility

-

Decide whether income should be accelerated or deferred

-

Evaluate whether bonuses or distributions make sense before year-end

-

Identify any purchases that meaningfully reduce taxable income and support the business

The goal isn’t to chase deductions—it’s to make intentional decisions while options still exist.

2. Clean the Books (For Real)

Tax planning only works if the numbers are accurate.

“Close enough” books lead to:

-

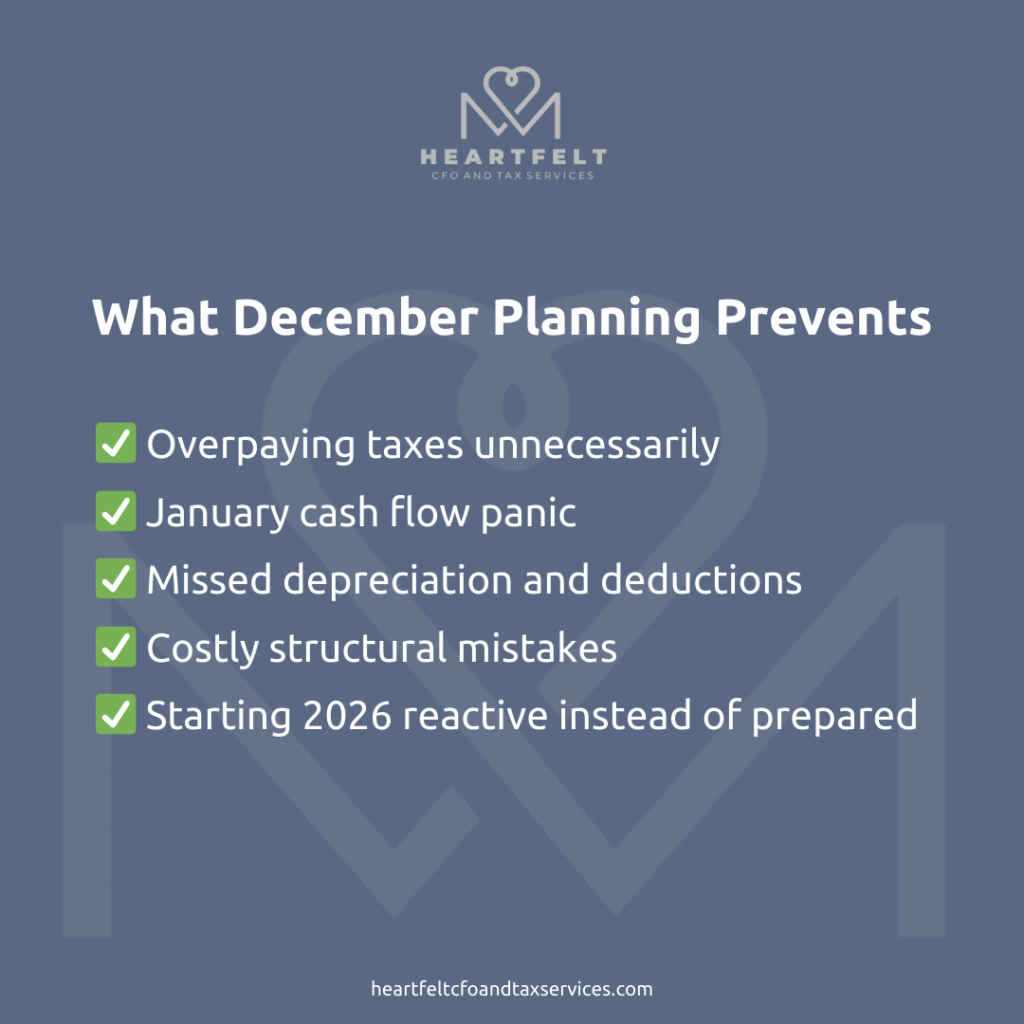

Overpaying taxes

-

Making the wrong decisions

-

Constant second-guessing

-

Unnecessary stress

If your numbers aren’t clean, no strategy built on top of them will be reliable.

Steps to Take Now

-

Reconcile all bank and credit card accounts

-

Review expense categorization for accuracy

-

Confirm payroll and owner compensation are recorded correctly

-

Clear uncategorized or suspense items

-

Close out each month properly—not loosely

Clean books aren’t about perfection. They’re about trust. You should be able to look at your numbers and believe them.

3. Recheck Your Entity and Payroll Setup

What worked when revenue was lower can quietly become a money leak as you grow.

This is one of the most overlooked areas in growing businesses.

Entity structure, owner pay, and payroll strategies need to evolve alongside income. When they don’t, inefficiencies compound quietly in the background.

Steps to Take Now

-

Review current entity structure in light of current income

-

Evaluate owner compensation strategy

-

Confirm payroll setup aligns with tax strategy

-

Identify whether changes should be planned for the new year

This isn’t about making changes for the sake of it. It’s about ensuring your structure still supports the business you’re running now—not the one you started.

4. Plan Cash on Purpose

Your bank balance is not your profit.

And relying on it as a decision-making tool is what creates January panic.

Without a clear cash plan, business owners often:

-

Underestimate upcoming tax obligations

-

Overdraw personally

-

Delay payments unnecessarily

-

Feel anxious even when revenue looks strong

Steps to Take Now

-

Map expected tax payments

-

Identify debt obligations and timelines

-

Clarify realistic owner pay

-

Separate “available” cash from future commitments

Planning cash intentionally now allows January to start calm and controlled—rather than reactive.

5. Use Timing Strategically

Timing is one of the most powerful—and misunderstood—tools in financial planning.

Depreciation elections, losses, and asset purchases work best when they’re done intentionally. Not rushed in April. Not guessed at later.

Steps to Take Now

-

Review assets already purchased this year

-

Identify whether additional purchases make sense before year-end

-

Evaluate depreciation strategies

-

Confirm how losses or carryforwards should be handled

Timing doesn’t mean rushing. It means deciding deliberately while choices are still available.

How Financial Mistakes Compound (And How to Stop Them)

Most financial mistakes don’t come from ignorance.

They come from:

-

Waiting too long

-

Avoiding the numbers

-

Treating planning as optional

-

Making decisions without context

These mistakes compound quietly. Not because anything went “wrong,” but because no one was watching the whole picture.

The fix isn’t complexity. It’s awareness, structure, and support.

Year-End Planning Isn’t About Doing More

It’s about keeping more.

It’s about closing the year intentionally and starting the next one clear, calm, and prepared—rather than reactive and stressed.

And it’s not something you have to figure out alone.

Ready to Start 2026 Clear Instead of Guessing?

If you’re a business owner who wants clarity instead of anxiety—and support instead of scrambling—this is exactly the moment to act.

A short conversation now can:

- Identify missed opportunities

- Clarify what still can be done

- Prevent unnecessary stress in the new year

You don’t need a commitment. You need clarity.

Schedule a meeting to review where you are, what’s still possible, and how to move into 2026 with intention.