You’re Not Behind — You’re Just at the Right Moment

If January has you staring at your books thinking, “I should have dealt with this already,” pause for a moment.

That feeling isn’t failure — it’s awareness.

Most New Jersey business owners start the year carrying a mix of unfinished bookkeeping, unanswered tax questions, and quiet worry about whether they’re doing things “right.” And because finances often come with shame, it’s easy to assume everyone else is more organized than you.

They’re not.

January is simply the first calm window where clarity becomes possible again. And starting now — even imperfectly — puts you ahead of where you were yesterday.

This is not about catching up.

It’s about resetting.

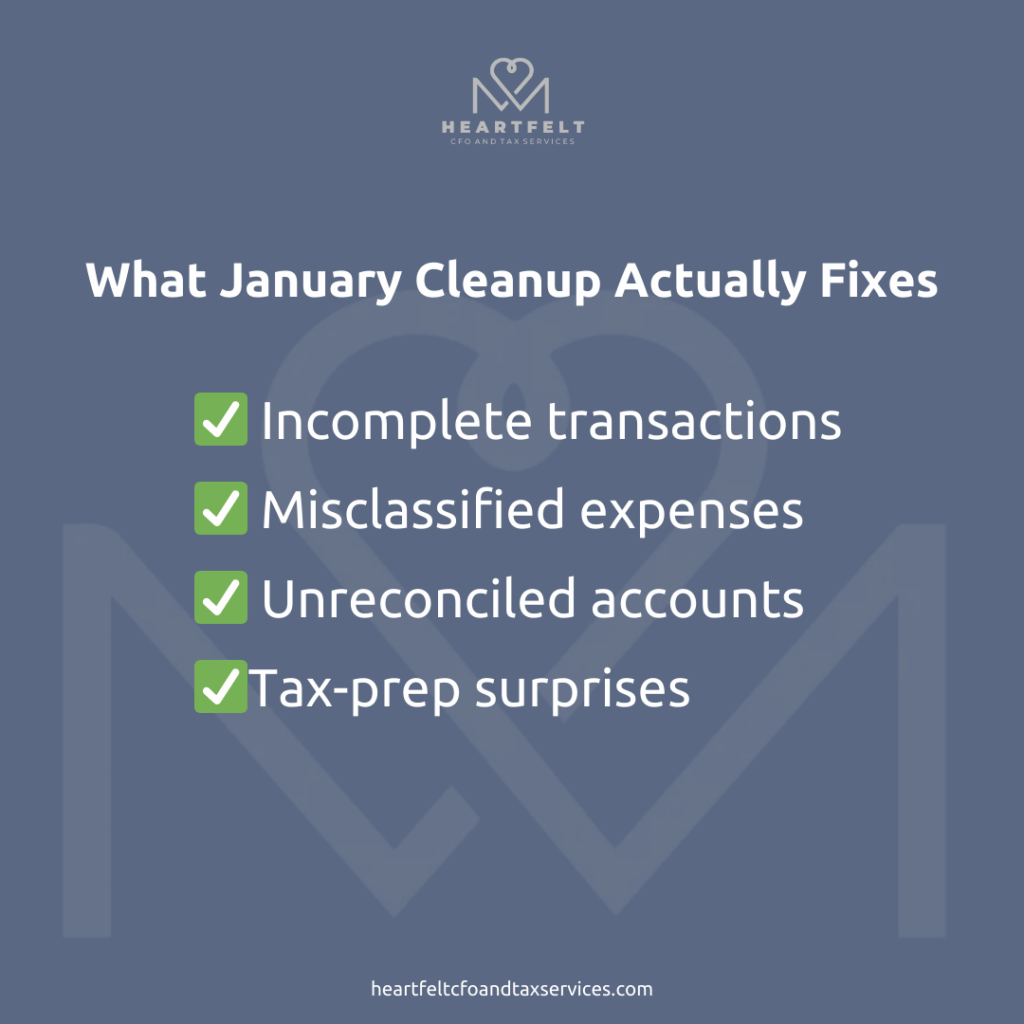

What “Financial Cleanup” Actually Means

When we say January financial cleanup, we don’t mean spreadsheets all weekend or digging through every receipt you’ve ever touched.

Financial cleanup means:

-

Making sure your books are accurate

-

Your accounts make sense

-

And your numbers can be trusted before tax prep begins

For NJ business owners, this matters even more because state and federal tax rules overlap, deadlines stack quickly, and small errors can quietly snowball into penalties or missed savings.

Think of cleanup as clearing the fog — not judging the past.

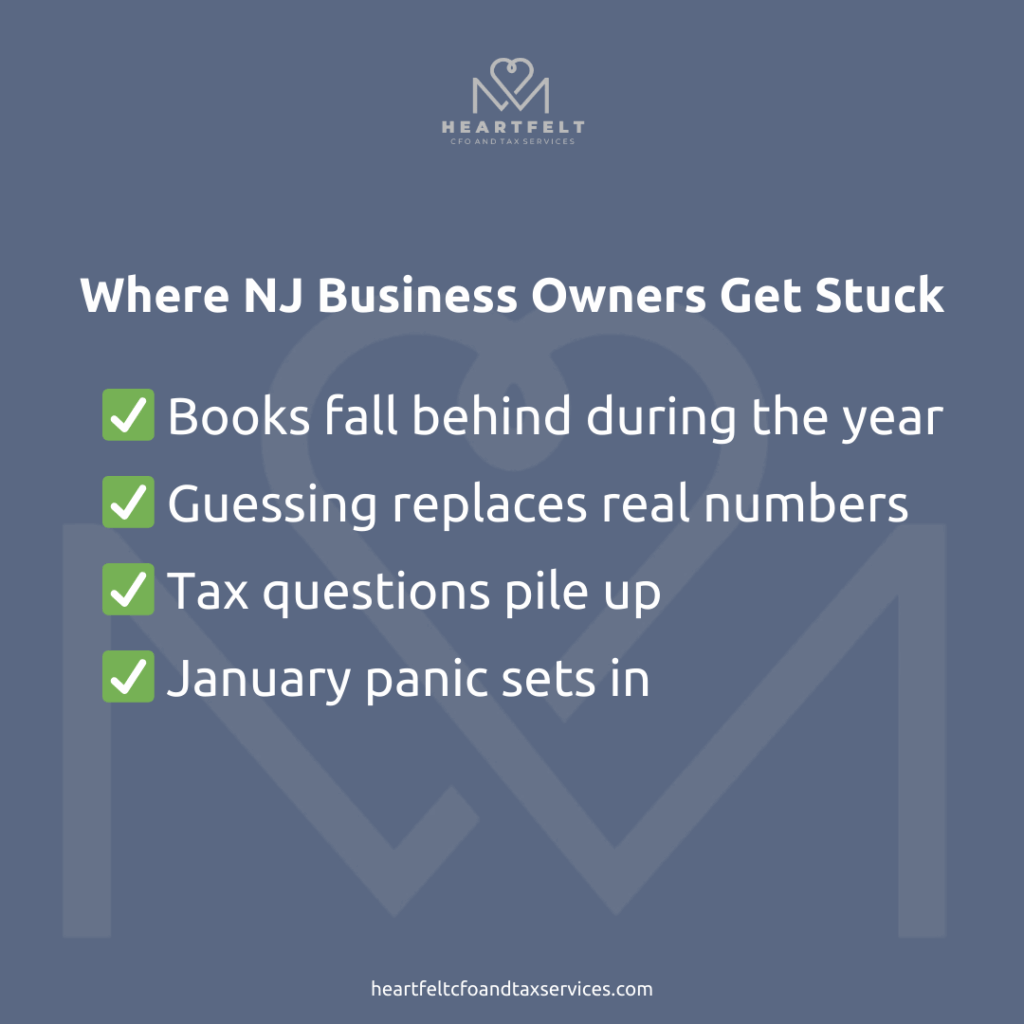

Common (Very Normal) Mistakes NJ Business Owners Make

We see these every January — and none of them mean you’ve done anything wrong.

Extremely common issues include:

-

Mixing personal and business expenses

-

Missing or inconsistent categorization

-

Bookkeeping that stopped mid-year

-

Relying on bank balances instead of reports

-

Not knowing whether you’re overpaying taxes

Most of the time, business owners were focused on clients, growth, or survival — not perfect records. Cleanup is simply the next stage of maturity.

The Heartfelt January Cleanup Framework

Cleanup → Organization → Clarity → Tax Readiness

This is the same calm, repeatable path we use with NJ clients every year.

Step 1: Cleanup

Fix what’s incomplete or inaccurate.

-

Reconcile bank and credit card accounts

-

Correct miscategorized expenses

-

Bring bookkeeping current

Step 2: Organization

Create structure so things stay clean.

-

Separate personal vs. business spending

-

Confirm chart of accounts

-

Align records with NJ tax requirements

Step 3: Clarity

Turn numbers into understanding.

-

Review profit & loss and balance sheet

-

Understand cash flow patterns

-

Identify red flags early

Step 4: Tax Readiness

Prepare proactively — not reactively.

-

Confirm deductions

-

Identify tax-saving opportunities

-

Enter tax prep confident and calm

Realistic NJ Business Owner Scenario

Let’s say you’re a New Jersey service provider — maybe a consultant, therapist, or small agency owner.

By January:

-

Your books are mostly done, but not fully reconciled

-

You’re unsure which expenses are deductible in NJ

-

You’re anxious about what your accountant might say

After cleanup:

-

Your reports are accurate

-

Your tax preparer has clean data

-

You finally understand where your money went

Nothing about your business changed.

Only your clarity did.

Why This Matters (Financially and Emotionally)

Financial cleanup isn’t just about taxes.

It affects:

-

Cash flow: You stop guessing and start planning

-

Taxes: You avoid overpaying or missing deductions

-

Stress: Your brain stops carrying unresolved questions

-

Decisions: Pricing, hiring, and growth become clearer

Clarity creates confidence.

Confidence creates better choices.

Better choices protect your business — and your nervous system.

This is why we see tax planning as a form of self-care.

Practical, Calming Next Steps You Can Take Now

You don’t need to do everything today.

Start here:

- Download bank and credit card statements for last year

- List any months where bookkeeping feels unclear

- Separate personal and business expenses moving forward

- Write down tax questions instead of holding them mentally

- Decide whether you want support — not struggle — this year

Each step creates momentum without overwhelm.

Choose the Path That Fits You

If you’re unsure where things stand or what you need next, book a meeting with us. We’ll help you understand your numbers — without judgment or pressure.

If you already know your books need attention and you’re ready to move forward, purchase a cleanup or planning package and let us take this off your plate.

Either way, January is not about fixing the past.

It’s about creating clarity → confidence → action for the year ahead.