If your business is making more money than it used to, but you somehow feel more anxious — not less — you’re not broken. You’re just operating without financial clarity.

This is one of the most common situations we see with business owners across New York, New Jersey, and nationwide: revenue is growing, but stress is growing faster And it’s usually not because you’re bad with money. It’s because no one ever set the system up to support growth.

The Quiet Problem No One Warns You About

Most business owners are taught how to start a business, not how to run one sustainably. So what happens?

– You open accounts

– You hire a bookkeeper (or do it yourself)

– You file taxes once a year

– You hope nothing blows up

On paper, you’re “doing the right things.”

In reality, your financial picture is fragmented. One person handles bookkeeping. Another handles taxes. No one is responsible for the full story.

That gap is where anxiety lives.

“I’m Profitable… So Why Does This Feel So Fragile?”

Here’s what we hear all the time:

– “I don’t actually know how much I can pay myself.”

– “I’m scared to spend, even though revenue looks good.”

– “I’m constantly behind, even when things are ‘fine.’”

– “I’m worried I’m missing something big.”

That feeling comes from reactive finances.

You’re looking backward instead of forward. And that’s dangerous once your business starts scaling.

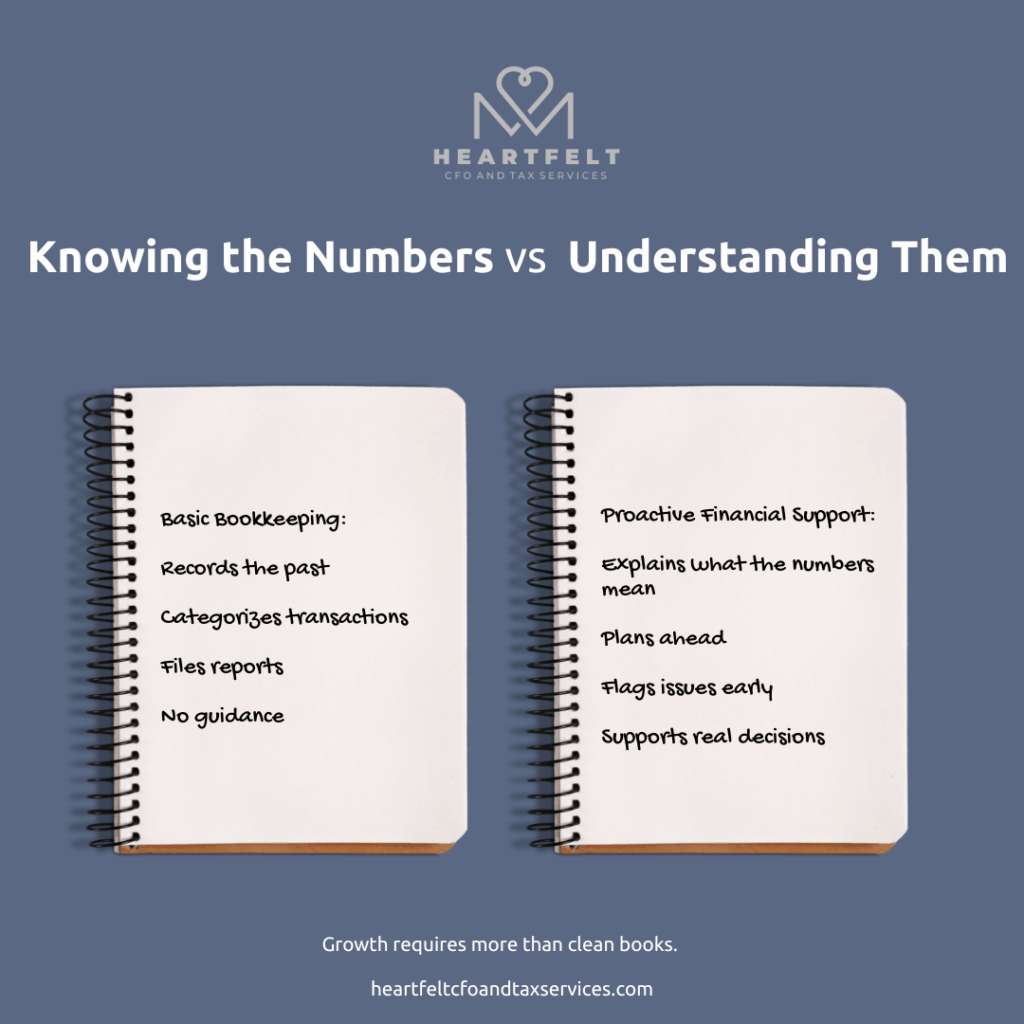

The Difference Between Bookkeeping and Financial Support

Let’s be very clear, because this is where people get burned.

Bookkeeping answers:

– What happened last month?

– Did transactions get categorized?

– Are the numbers clean?

That’s necessary — but it’s not enough.

True financial support answers:

– What do these numbers mean?

– What should I do next?

– How do I avoid problems before they happen?

This is where proper bookkeeping and accounting services stop being an expense and start becoming a safety net.The Cost of Waiting Until “Something Is Wrong”

Many business owners wait until they get hit with a surprise tax bill, cash flow tightens unexpectedly, or growth creates chaos instead of freedom.

By the time there’s a “problem,” you’re already behind.

Preventative financial planning is quieter, less dramatic, and far more effective.

What Financial Safety Actually Looks Like

When your finances are set up correctly, you should feel:

– Calm when money comes in

– Confident when money goes out

– Clear on what’s available — and what’s not

– Supported when decisions need to be made

You don’t need to be a finance expert. You just need someone whose job is to protect the whole picture.

Who This Matters Most For

This is especially relevant if you’re a service-based business owner, scaling past the scrappy phase, earning more but feeling less stable, and tired of guessing.

If you’ve outgrown DIY finances but don’t need a full internal finance department, this is exactly the gap we fill.

About Heartfelt CFO & Tax Services

At Heartfelt CFO & Tax Services, our entire ethos is built around one core principle: safety.

Financial safety. Emotional safety. Decision-making safety.

We work with business owners who don’t want aggressive, transactional advice — they want clarity, partnership, and a steady hand guiding their financial life.

Heartfelt supports growing service-based businesses, founders, creatives, and operators who value transparency, long-term thinking, and proactive guidance. Our clients are not looking for the cheapest option or a one-size-fits-all solution. They’re looking for a trusted financial partner who understands the weight of responsibility that comes with running a business.

Our work blends clean bookkeeping, proactive tax strategy, forward-looking planning, and real human support — so our clients can make decisions from a place of confidence instead of fear.

If you’re ready to feel grounded instead of guessing, the next step is simply to talk. Schedule a discovery call here.