You’re Not Wrong for Being Confused

If you’ve ever thought:

-

“Isn’t this what a financial advisor does?”

-

“Do I need investing help… or tax help… or something else?”

-

“I know I should be doing more with my finances, but I don’t even know who to ask.”

You’re not behind.

You’re not uneducated.

And you’re definitely not alone.

Most small business owners come to us carrying quiet confusion — not because they aren’t capable, but because the financial world uses overlapping language that makes everything feel more complicated than it needs to be.

One of the most common things we hear is:

“I thought I needed a financial advisor… but that didn’t feel right.”

And that instinct is important.

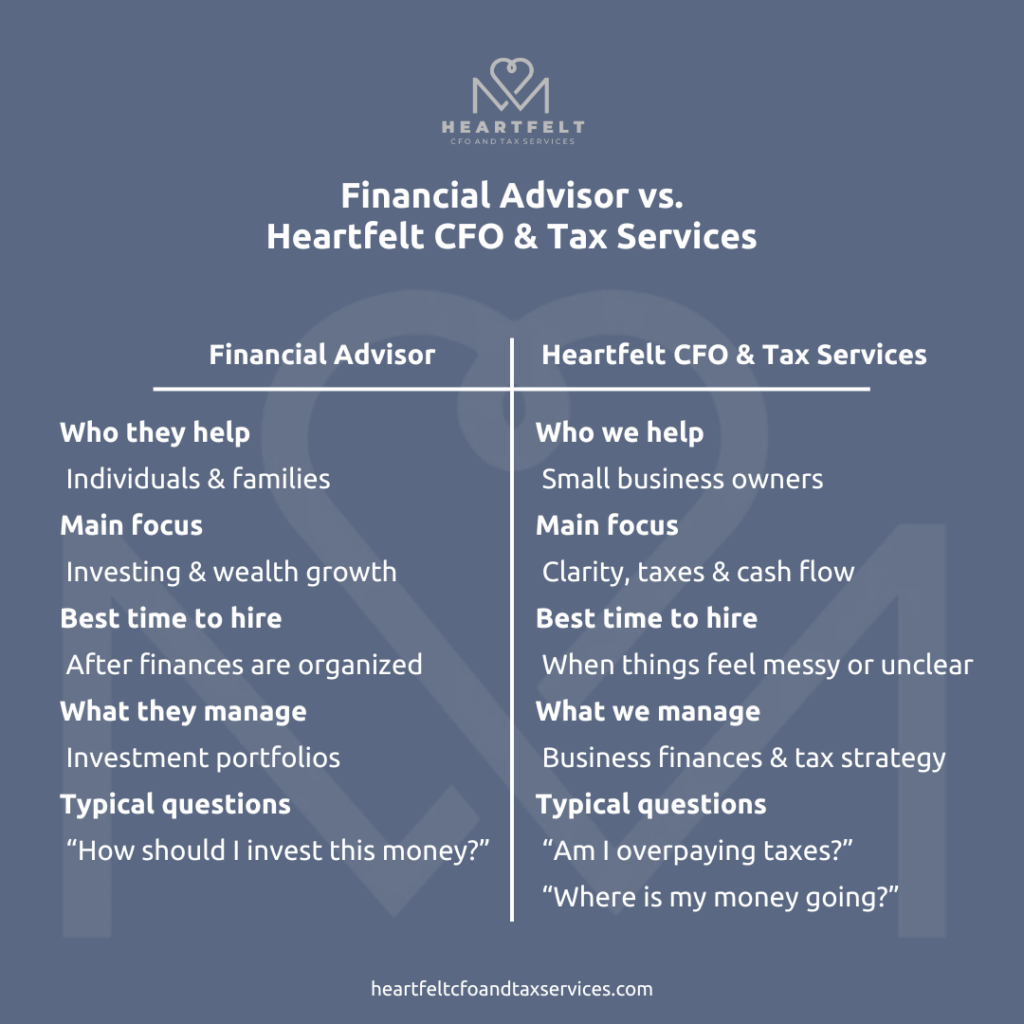

Because what Heartfelt does — and what a financial advisor does — are very different roles, designed for very different stages of financial life.

This post is here to gently clear that up.

What People Mean When They Say “Financial Advisor”

When most people hear financial advisor, they think of someone who helps with:

-

Investing money

-

Retirement accounts

-

Stocks, bonds, or portfolios

-

Wealth growth once money is already organized

And that’s accurate.

A financial advisor typically works with individuals or families who already have:

-

Clean personal finances

-

Predictable income

-

Investable assets

-

Clear separation between personal and business money

Their job is to help you grow wealth that already exists.

That’s not what Heartfelt CFO & Tax Services is built to do.

The Common Mistake (And Why It’s So Normal)

Many business owners assume:

“Once I make more money, I’ll hire a financial advisor.”

But the real issue isn’t investing yet.

The real issues usually sound like:

-

“My books are behind.”

-

“I don’t know if I’m overpaying taxes.”

-

“My cash flow feels tight even though revenue is up.”

-

“I’m scared to look at my numbers.”

-

“I don’t know what to pay myself.”

-

“I don’t know if I should become an S-Corp.”

-

“I feel like I’m guessing every quarter.”

These are foundational business finance problems, not investment problems.

Trying to solve them with a financial advisor is like trying to decorate a house before the foundation is poured.

Nothing is wrong with you for feeling this mismatch — it’s extremely common.

The Heartfelt Difference: What We Actually Do

At Heartfelt CFO & Tax Services, we work inside your business finances, not around them.

Here’s the simplest way to think about it:

A financial advisor helps you invest money.

We help you understand, protect, and structure the money your business is already making.

We focus on:

-

Bookkeeping cleanup and organization

-

Monthly clarity (not just compliance)

-

Tax planning for small business owners

-

Cash flow support

-

Entity strategy (including “Should I become an S-Corp?”)

-

Ongoing CFO-level guidance without CFO-level overwhelm

This is not about Wall Street.

This is about real life business decisions.

The Heartfelt Clarity Path (Our Framework)

Most of our clients move through the same progression — even if they don’t realize it at first.

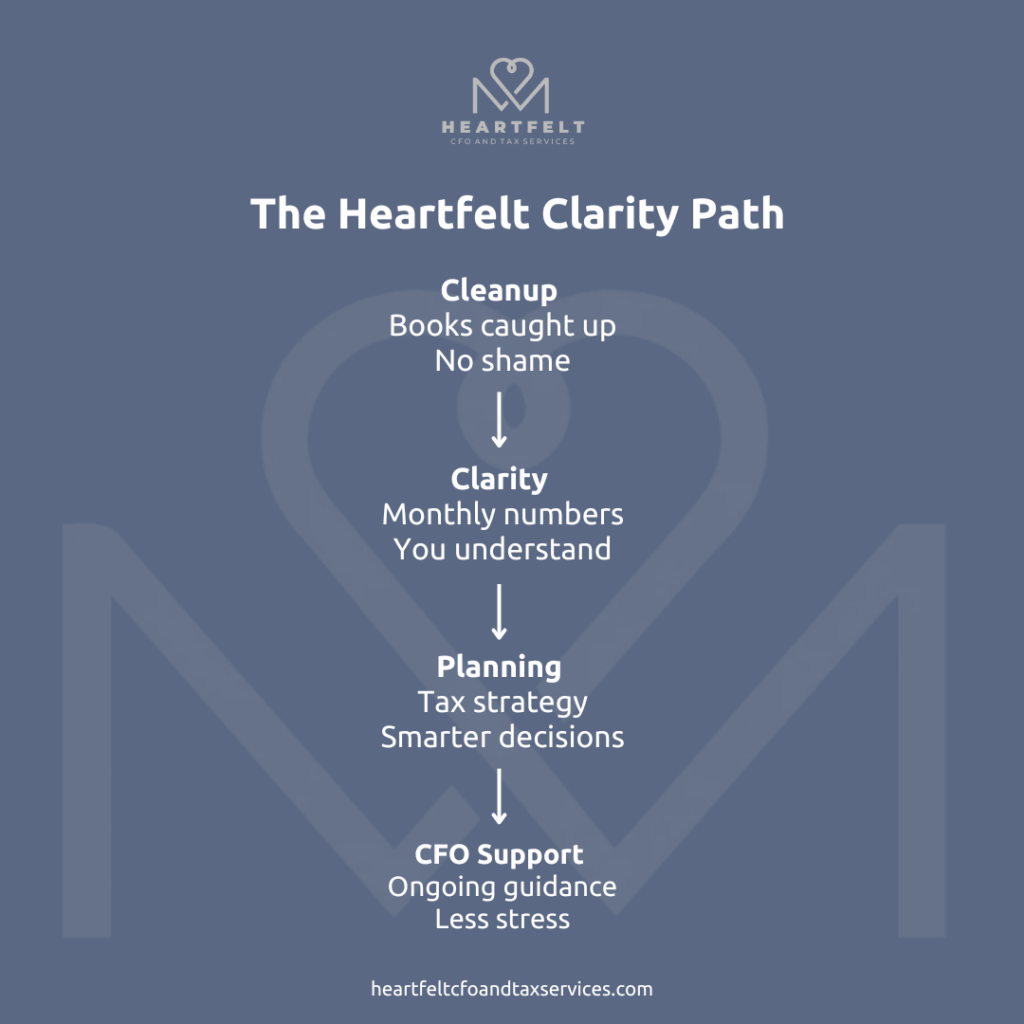

The Cleanup → Clarity → Planning → CFO Path

Step 1: Cleanup

-

Bookkeeping cleanup

-

Catching up months (or years) of disorganization

-

Removing shame from the process

Step 2: Clarity

-

Monthly financials you actually understand

-

Knowing where your money is going

-

Seeing cash flow clearly

Step 3: Planning

-

Small business tax planning

-

Year-end tax strategy

-

Answering “Am I overpaying taxes?”

-

Evaluating S-Corp eligibility

Step 4: CFO Guidance

-

Ongoing strategic support

-

Fewer meetings, more done-for-you

-

Calm decision-making

-

Growth with structure

This is where financial maturity begins — long before investing enters the picture.

A Realistic Example

Let’s talk about Sarah.

Sarah runs a growing therapy practice. Revenue is up. Her CPA files her taxes every year. She assumes that means things are “fine.”

But Sarah:

-

Has no idea if she’s overpaying taxes

-

Doesn’t know if an S-Corp would help

-

Feels anxious every time she logs into her bank account

-

Isn’t paying herself consistently

-

Avoids her bookkeeping software entirely

She wonders if she needs a financial advisor.

But what Sarah actually needs is:

-

Bookkeeping cleanup

-

Clear monthly reports

-

Proactive tax planning

-

A CFO-level partner who understands service-based businesses

Once those pieces are in place, then investing conversations make sense.

Heartfelt meets clients before the investing stage — when clarity matters most.

Why This Difference Matters (Financially & Emotionally)

When you work with the wrong kind of support:

-

You stay confused longer

-

You delay important tax decisions

-

You overpay taxes unnecessarily

-

You feel shame instead of confidence

-

You stay stuck in reaction mode

When you have the right support:

-

You understand your numbers

-

You make decisions calmly

-

You stop avoiding your finances

-

You feel in control again

-

You build confidence step by step

This is why we say tax planning is self-care.

Because clarity reduces stress.

And structure creates freedom.

Practical Next Steps You Can Take Now

If you’re unsure what kind of support you actually need, start here:

- Ask yourself: Do I understand my monthly numbers — or just hope they’re fine?

- Notice: Do tax decisions feel proactive or last-minute?

- Check: Are my books clean enough to support planning?

- Reflect: Am I making decisions from clarity or anxiety?

- Decide: Do I want guidance — or done-for-you support?

You don’t need to have all the answers before reaching out.

If you’re realizing:

-

“I don’t need investing advice yet — I need clarity.”

-

“I want to stop guessing.”

-

“I want support that actually fits where my business is.”

You have two calm, supportive next steps:

If you want clarity, direction, and help deciding what support makes sense right now. Book a virtual coffee chat.

If you already know you need bookkeeping cleanup, tax planning, or structured CFO support — and you’re ready to move forward. Select one of our packages.

You don’t have to figure this out alone.

And you don’t need to be “better” with money to get help.

Clarity comes first.

Confidence follows.