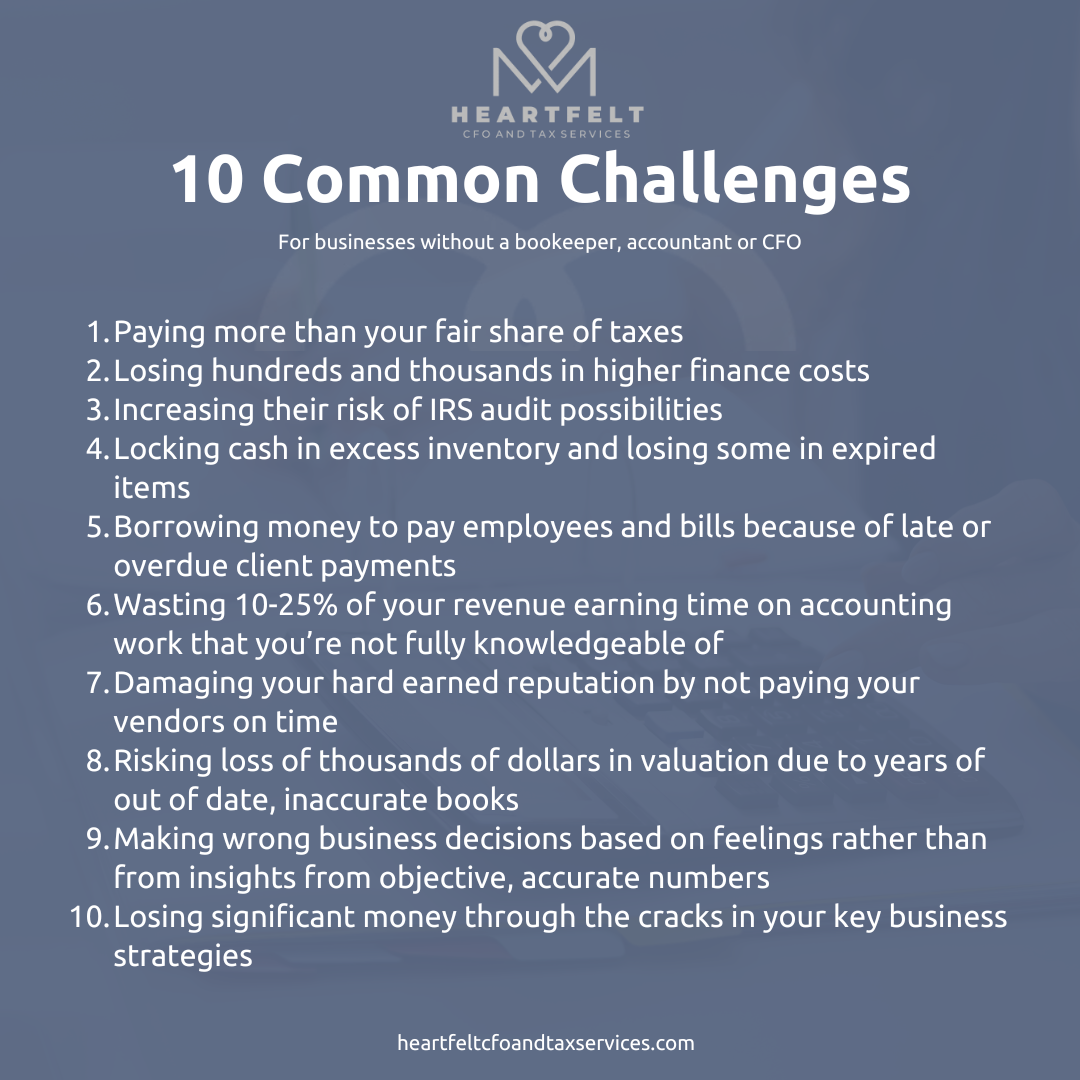

Navigating the financial landscape of your business can feel overwhelming. It’s tempting to handle it all yourself, but without professional guidance, you might be unknowingly leaving money on the table. Let’s break down the real costs of not having a financial expert by your side:

1. Overpaying Taxes

Without strategic tax planning, you could be giving away more than necessary. A seasoned accountant ensures you’re leveraging all available deductions and credits, keeping more money in your pocket.

2. High Financing Costs

Disorganized financial records can lead to unfavorable loan terms. A CFO presents your business in the best light, helping secure loans with better interest rates.

3. Increased Audit Risk

Inaccurate or incomplete records can trigger audits. Professional bookkeeping maintains meticulous records, reducing red flags and ensuring compliance.

4. Tied-Up Cash in Inventory

Excess inventory means cash that’s not working for you. A financial expert helps optimize inventory levels, freeing up funds for other investments.

5. Cash Flow Issues

Late client payments can disrupt your ability to cover expenses. An accountant implements effective invoicing and collection strategies to maintain steady cash flow.

6. Time Drain

Spending hours on bookkeeping takes you away from growing your business. Delegating to a professional allows you to focus on what you do best.

7. Damaged Vendor Relationships

Late payments to suppliers can harm your reputation. Consistent financial management ensures timely payments, preserving valuable partnerships.

8. Decreased Business Valuation

Outdated or inaccurate books can lower your company’s value. Accurate financial records reflect a healthy, valuable business.

9. Poor Decision-Making

Without clear financial insights, decisions are based on guesswork. A CFO provides data-driven insights for informed choices.

10. Missed Profit Opportunities

Unrecognized financial leaks can drain profits. Regular financial reviews identify and plug these gaps, boosting your bottom line.

How Heartfelt CFO Can Help

At Heartfelt CFO and Tax Services, we believe in making numbers approachable and reducing the stress around finances. Our Bookkeeping and accounting services are designed to provide clarity and confidence in your financial decisions.

Proactive Package – Month-End Bookkeeping and Planning Ahead

Our Proactive Package offers more than just number crunching. We partner with you to keep your books accurate and up-to-date, anticipate tax liabilities, and manage cash flow effectively. This proactive approach ensures you’re prepared for the future, not just reacting to the present. Learn more about it here: https://heartfeltcfoandtaxservices.com/our-packages/

Schedule a Free Consultation Today

Ready to transform your relationship with your business finances? Schedule a call with Heartfelt CFO and Tax Services today to develop a customized financial strategy that saves you time, money, and stress.