As a tax strategist and CFO for real estate professionals, I see it all too often: talented business owners working hard, growing their businesses—but still constantly looking over their shoulder during tax season.

Here’s the truth: IRS audits aren’t always random. In many cases, they’re avoidable. And with a few smart changes, you can reduce your audit risk while keeping more of what you earn.

Let’s walk through six strategies that can keep the IRS off your back—without sacrificing your growth.

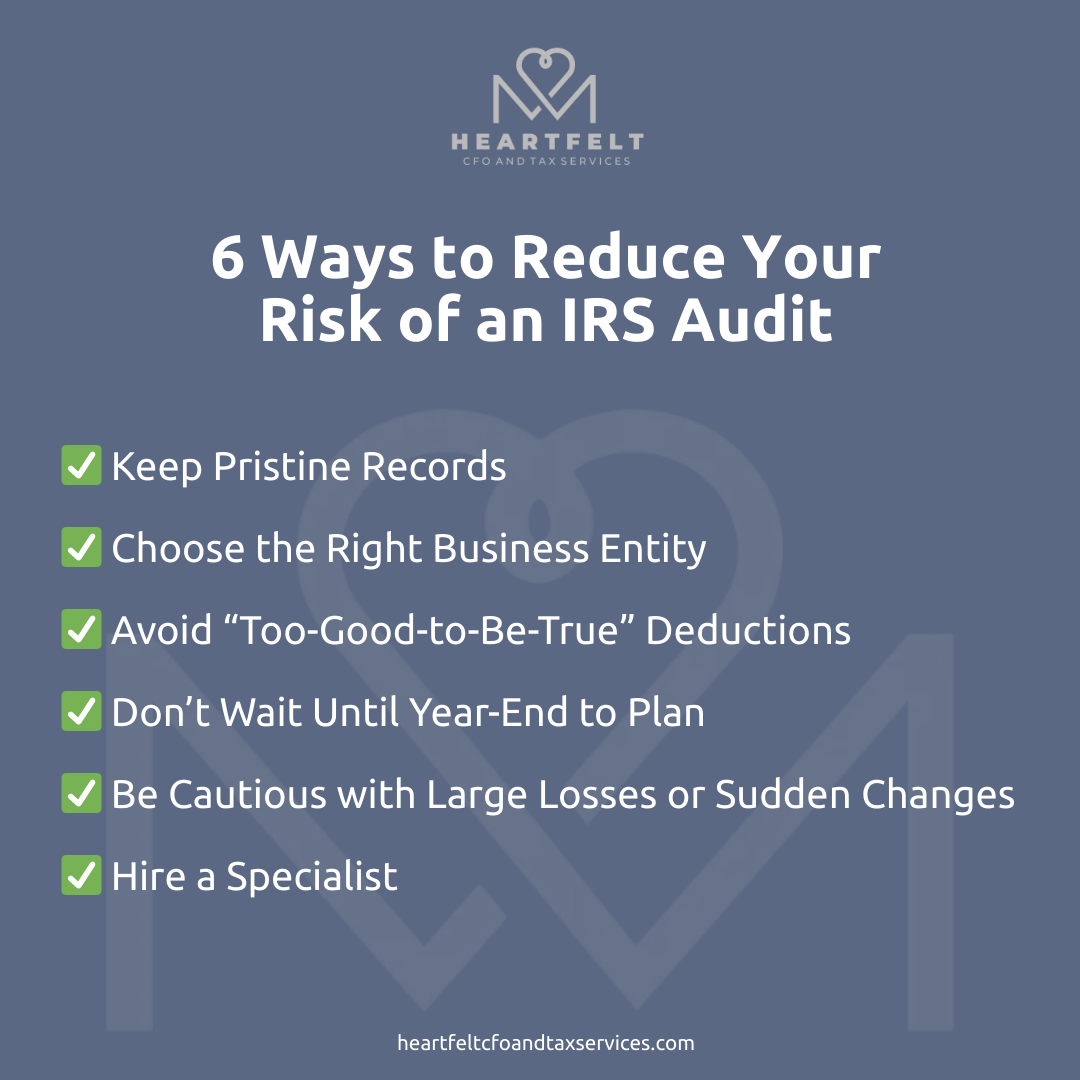

1. Keep Pristine Records

Messy bookkeeping is one of the biggest audit triggers. If your numbers don’t match up or your documentation is incomplete, red flags go up fast.

Our advice: Keep clean, reconciled books every month. Store receipts, categorize expenses properly, and make sure your reports match your returns.

2. Choose the Right Business Entity

Your legal structure matters—not just for taxes, but for how your business is scrutinized. Certain entities (like sole proprietorships) are audited more frequently than others.

Our advice: Work with a professional to evaluate whether an S-Corp, LLC, or other structure better suits your growth and audit protection goals.

3. Avoid “Too-Good-to-Be-True” Deductions

Claiming a home office deduction when you work at a café? Writing off lavish dinners as “team meetings”? These kinds of moves raise eyebrows quickly.

Our advice: Claim only what’s reasonable—and keep documentation. Every deduction should have a purpose and a paper trail.

4. Don’t Wait Until Year-End to Plan

One of the most common mistakes we see? Scrambling at tax time with no clear strategy. When you’re reactive, mistakes get made—and mistakes get audited.

Our advice: Use a tax calendar. Plan quarterly. Meet with a tax professional throughout the year—not just in March or April.

5. Be Cautious with Large Losses or Sudden Changes

Reporting a massive loss one year and a big profit the next without explanation? The IRS might want to take a closer look.

Our advice: If your business had a major shift (like a pivot or sale), prepare documentation to explain the numbers. Transparency goes a long way. Reporting a massive loss one year and a big profit the next without explanation? The IRS might want to take a closer look.

Our advice: If your business had a major shift (like a pivot or sale), prepare documentation to explain the numbers. Transparency goes a long way.

6. Hire a Specialist

Trying to handle taxes on your own can save money in the short term—but cost you big later if it results in an audit. A qualified expert can spot red flags, navigate complex deductions, and keep your filings clean and compliant.

Our advice: Work with a tax strategist who understands your industry—especially one experienced with real estate professionals.

Heartfelt CFO specializes in supporting real estate entrepreneurs with proactive guidance, ongoing planning, and done-for-you financial clarity. If you’re looking for a trusted bookkeeping consultant who understands your business, we’re here to help. with proactive guidance, ongoing planning, and done-for-you financial clarity.

The Heartfelt CFO Approach

We help real estate professionals avoid IRS issues before they start—with a proactive, monthly system built around clarity and control.

Our Proactive Package includes:

- Month-end bookkeeping so your records are always audit-ready

- Strategic tax planning, customized to your goals

- Support from a team that knows your business and industry

Learn at Your Own Pace

Not ready for full-service support? Our Online Learning Hub is packed with courses and downloadable tools on:

- Audit-proofing your finances

- Choosing the right business entity

- Understanding real estate tax deductions

👉 Explore our full course library here: Courses + Resources

Let’s Reduce Risk and Boost Peace of Mind

You work hard to grow your business. Let us help you protect it. With the right systems, you won’t just sleep better at night—you’ll also save more, grow smarter, and avoid costly surprises.

👉 Book a free discovery call today

Looking for expert-level bookkeeping and accounting services that support your real estate business growth? We’ve got your back.

This blog post is part of Heartfelt CFO’s commitment to empowering real estate professionals with tools, insights, and systems to thrive financially. For more support, reach out anytime.