Another commission check hits your account—yet somehow, cash still feels tight.

You’re not alone.

Many real estate pros are growing their portfolios, winning deals, and racking up solid numbers on the P&L… but still struggling with cash flow or unsure whether their business is actually profitable. If that’s you, the missing piece is likely your balance sheet.

It’s not just an accounting formality. Your balance sheet is your financial GPS—without it, you’re just guessing at your next move.

What Your Balance Sheet Is Telling You (And Why You Should Listen)

In real estate, cash is king, but clarity is the true power play.

It’s easy to have money flowing in and out—only to find yourself scrambling when it’s time to pay contractors, investors, or lenders.

What’s going wrong? Too often, business owners shift money from one project to another, borrowing against future cash flow. That short-term thinking can snowball into serious financial blind spots.

This is where your balance sheet comes in.

What Is a Balance Sheet, and Why Do You Need One?

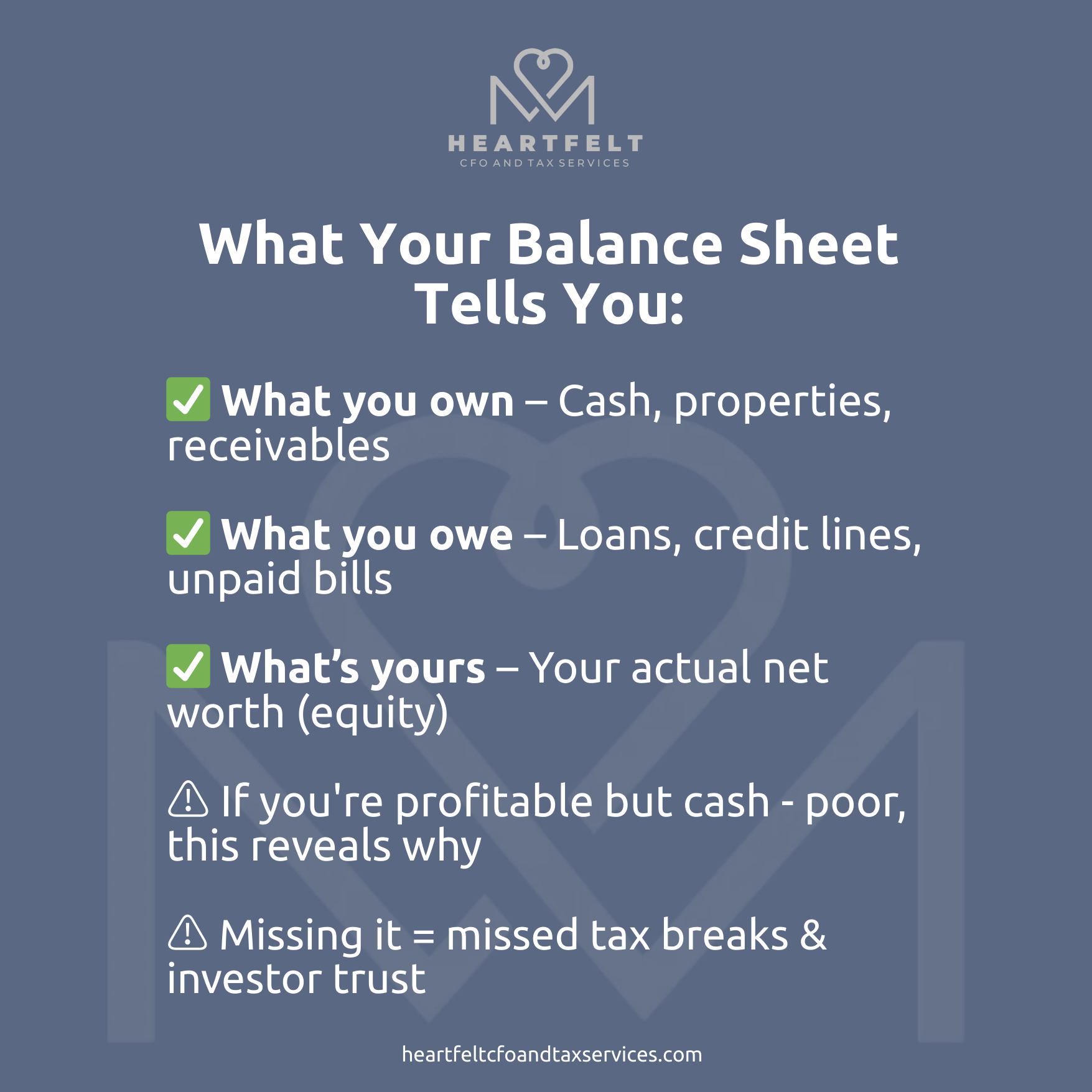

Your balance sheet is a snapshot of your business’s financial health. It tells you:

✅ What you own (assets) – Properties, bank accounts, receivables, investments

✅ What you owe (liabilities) – Loans, credit lines, unpaid invoices, tax liabilities

✅ What’s really yours (equity) – Your actual net worth after debts

You could be closing deals left and right, but if your liabilities are growing faster than your income, you’re not really ahead. You might be profitable on paper but drowning in liabilities.

Why Ignoring Your Balance Sheet Hurts Your Business

Let’s break it down:

-

You make risky financial moves – Without knowing your debt-to-asset ratio, you might be overleveraging.

-

You struggle with cash flow cycles – Too many projects and not enough capital leads to constant money shuffling.

-

You miss tax-saving opportunities – Some liabilities can be structured strategically, but only if you’re tracking them.

-

Lenders and investors lose confidence – A P&L without a balance sheet suggests a lack of financial oversight.

Bottom line? If you’re only looking at your profit & loss, you’re only seeing part of the story.

Stop Guessing. Start Winning.

It’s time to stop patching financial holes with future deals and start making strategic decisions. Your balance sheet is the roadmap—showing what’s working, what’s lagging, and what needs adjustment so you can move forward with clarity and confidence.

Let’s be real: Finances don’t have to feel overwhelming. With the right guidance, you can take back control of your business cash flow and start building toward sustainable growth.

Want help making sense of your balance sheet?

💡 Let’s work on your balance sheet together so you can win in the real estate maze of deals.

Start by booking a supportive, judgment-free discovery call with Margo. We’ll identify where the gaps are in your financial clarity and what steps will move you forward.

You can also explore our Proactive Package—a monthly support system that includes bookkeeping, financial reporting, and strategic tax planning. Or browse our online tools and courses to strengthen your financial foundation on your own time.