When you’re deep in the day-to-day of running your business, it’s easy to think financial planning is something you’ll “get to later.” But the truth is, life doesn’t wait for later.

One of our clients—a retail store owner—had no plan in place for emergencies. Then a medical crisis hit. Because of the systems we’d already implemented, he was able to take care of his health without worrying about business operations grinding to a halt.

Another client used to stress constantly about taxes. Their bookkeeping was always behind, and deadlines loomed like storm clouds. We helped them get current, streamlined their cash flow, and put a proactive tax strategy in place. Now? No late fees, no chaos, and no last-minute scrambles—just peace of mind and better savings.

These aren’t just feel-good stories. They’re reminders that when your financial systems are strong, your business becomes resilient. You’re not just reacting to crises—you’re prepared for them.

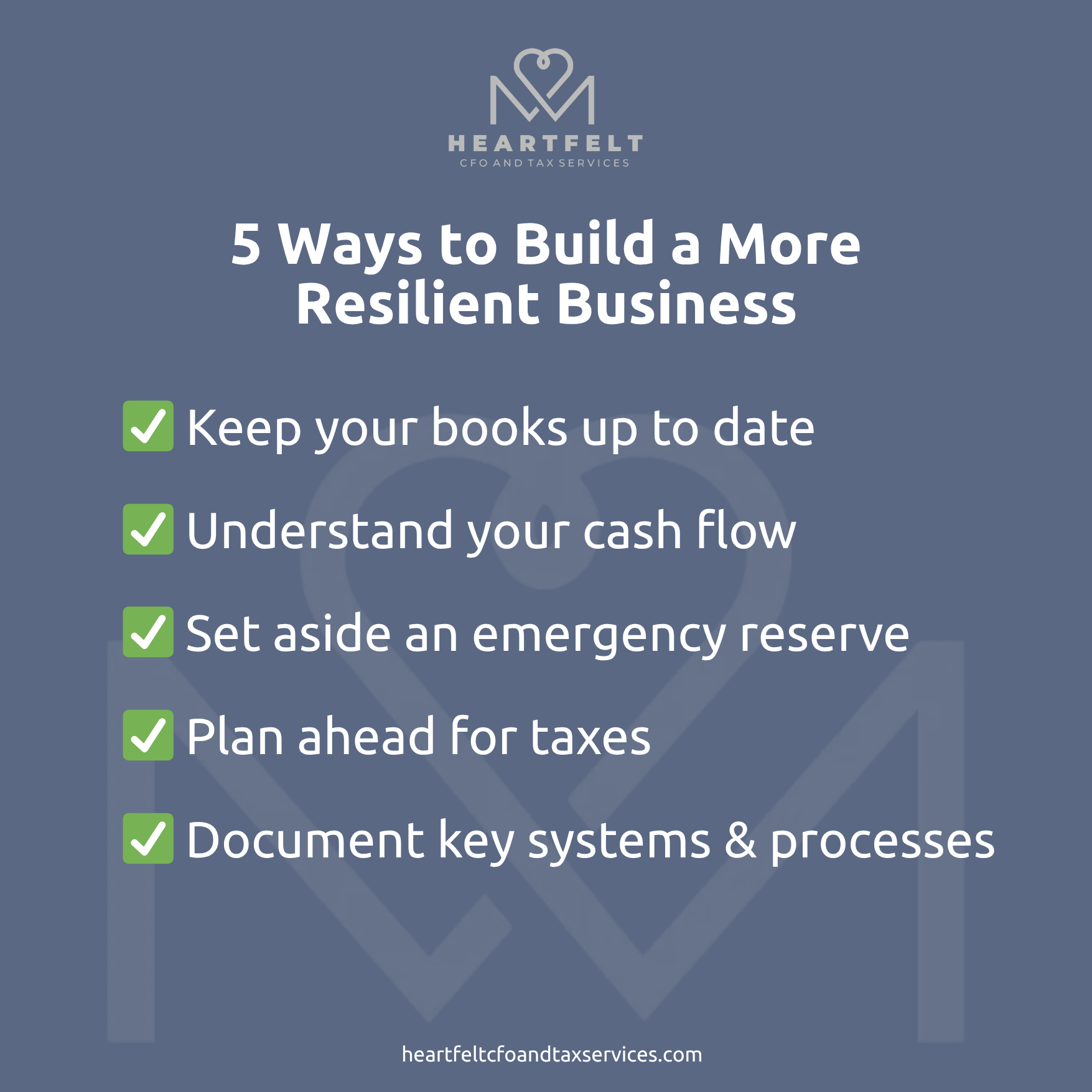

How to Build a More Resilient Business

If you’re ready to shift from reactive to proactive, here are a few steps to start with:

-

Stay current on your books. Regular bookkeeping gives you visibility and control.

-

Map out your cash flow. Know when money is coming in and going out so you can plan accordingly.

-

Build an emergency reserve. Just like personal finances, your business needs a rainy day fund.

-

Implement tax strategy early. Don’t wait for tax season—plan ahead and stay compliant.

-

Document your systems. So if you have to step away, your business can keep running.

Want a partner to help you implement these steps?

The Proactive Package includes monthly bookkeeping and tax strategy, so you’re never behind and never alone in managing your business finances.

Looking for DIY resources?

Check out our online tools and courses to get organized at your own pace.

Not sure what you need yet?

Book a discovery call for a supportive, judgment-free conversation where we’ll talk through your concerns and next steps.