It starts innocently enough.

You’re at Office Depot grabbing printer ink for your business, and toss a few school supplies for the kids into the cart. You swipe your personal debit card because it’s easier and promise yourself you’ll sort it out later.

Or maybe your business account is running low, so you temporarily cover payroll from your personal checking account.

When you’re juggling everything from running a team to managing your books, it’s easy to blur the lines between business and personal finances. But while it might seem like a harmless workaround, mixing money can create confusion, stress, and costly mistakes for small business owners and real estate investors.

Let’s talk about why it matters, and how to fix it with a few smart, stress-reducing habits.

Why Mixing Money Is More Dangerous Than You Think

When personal and business funds are tangled together, it’s not just messy, it’s risky. Here’s what’s really at stake:

-

Legal protection: If you’re an LLC or S-Corp and commingling funds, you could lose your limited liability status. That means your personal assets could be on the line in a legal dispute.

-

Tax-time chaos: Tracking down receipts and separating transactions at the eleventh hour is not only stressful, it’s a recipe for missing deductions or triggering an audit.

-

Inaccurate financials: You can’t make smart decisions when you don’t have a clear picture of your cash flow. Mixing money clouds your reporting and analysis.

-

Red flags for lenders and investors: Sloppy finances send the wrong message to people who might want to fund or partner with you.

-

Unpaid self: Without clear boundaries, many owners end up either underpaying themselves or bleeding business cash without realizing it.

The good news is that this is fixable, and it doesn’t have to feel overwhelming.

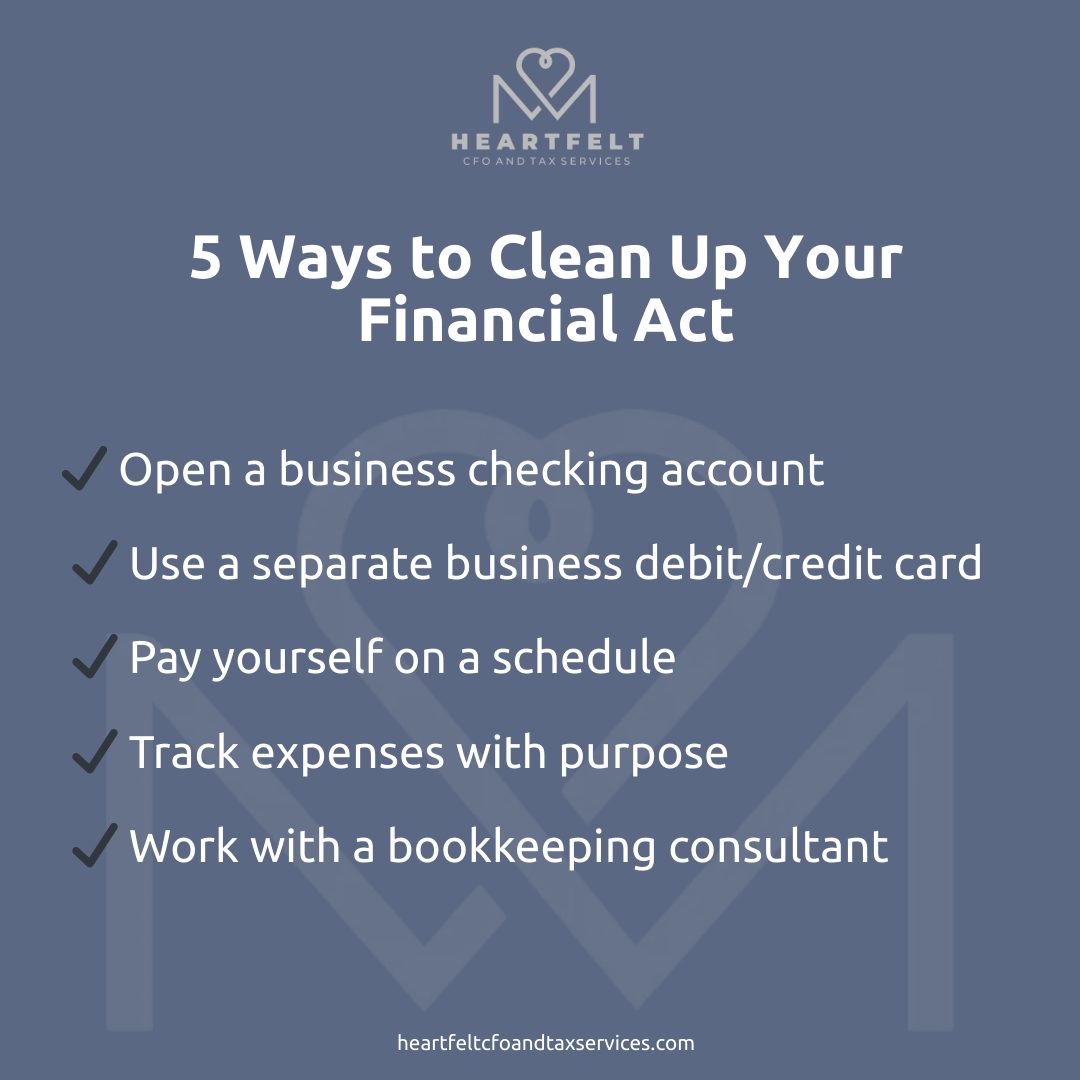

5 Ways to Clean Up Your Financial Act

You don’t have to be a spreadsheet wizard or accounting genius to stay organized. Start with these five simple moves:

-

Open a dedicated business checking account. If you haven’t yet, this is step one. Keep all income and expenses in one place.

-

Use a separate business credit or debit card. That way, every transaction is trackable, and you can earn rewards or build business credit along the way.

-

Pay yourself on a schedule. Whether it’s a weekly owner’s draw or a formal payroll setup, treat your pay like a non-negotiable.

-

Track your expenses with purpose. Use cloud bookkeeping software or hire a pro to categorize and reconcile everything monthly.

-

Bring in a bookkeeping consultant. A trained eye can help you set up clean systems and catch issues before they snowball.

Financial Clarity Reduces Stress

Finances and taxes don’t have to be stressful. When your money is organized and working for you, everything feels a little lighter. At Heartfelt CFO, we believe that clarity creates confidence, and we’re here to help you get there with real support and zero judgment.

Explore the Proactive Package

Ready to hand off the mess and finally feel in control of your books? Our Proactive Package includes monthly bookkeeping and tax strategy designed for business owners who want less stress and more structure, without the overwhelm.

Prefer to DIY (with Guidance)?

If you’re the hands-on type but want support you can trust, check out our online tools and courses. Learn how to manage your finances like a pro, on your schedule, with training that’s jargon-free and genuinely useful.

Book a Judgment-Free Call with Margo

Not sure where to start? That’s exactly what this is for.

Book a discovery call with Margo. This is a supportive, no-pressure conversation designed to help you talk through your financial concerns and figure out the best next step for your business.

You are not alone in this. You don’t have to figure it all out by yourself.