If you think tax planning starts with hunting for deductions, you’re skipping a chapter. The real starting line? Your bookkeeping.

Margo likes to call bookkeeping the “12 steps to an awesome tax return”—and she’s not wrong. Without accurate, well-organized books, even the smartest tax advisor is working with one hand tied behind their back.

The truth is, messy financial records create three big problems:

-

Misclassified expenses that might be overlooked when it’s time to strategize.

-

Valuation headaches if you need to prove the worth of your business to a lender, investor, or potential buyer.

-

Missed opportunities to legally reduce your tax bill because the numbers don’t clearly tell your story.

I’ve seen it happen—someone swears they’re keeping up with their books, but the categories are jumbled, receipts are half-missing, and income is posted in three different ways. Then tax time comes, and instead of implementing a sharp tax strategy, we’re stuck in clean-up mode. That’s the financial equivalent of spending your vacation fixing the roof instead of enjoying the beach.

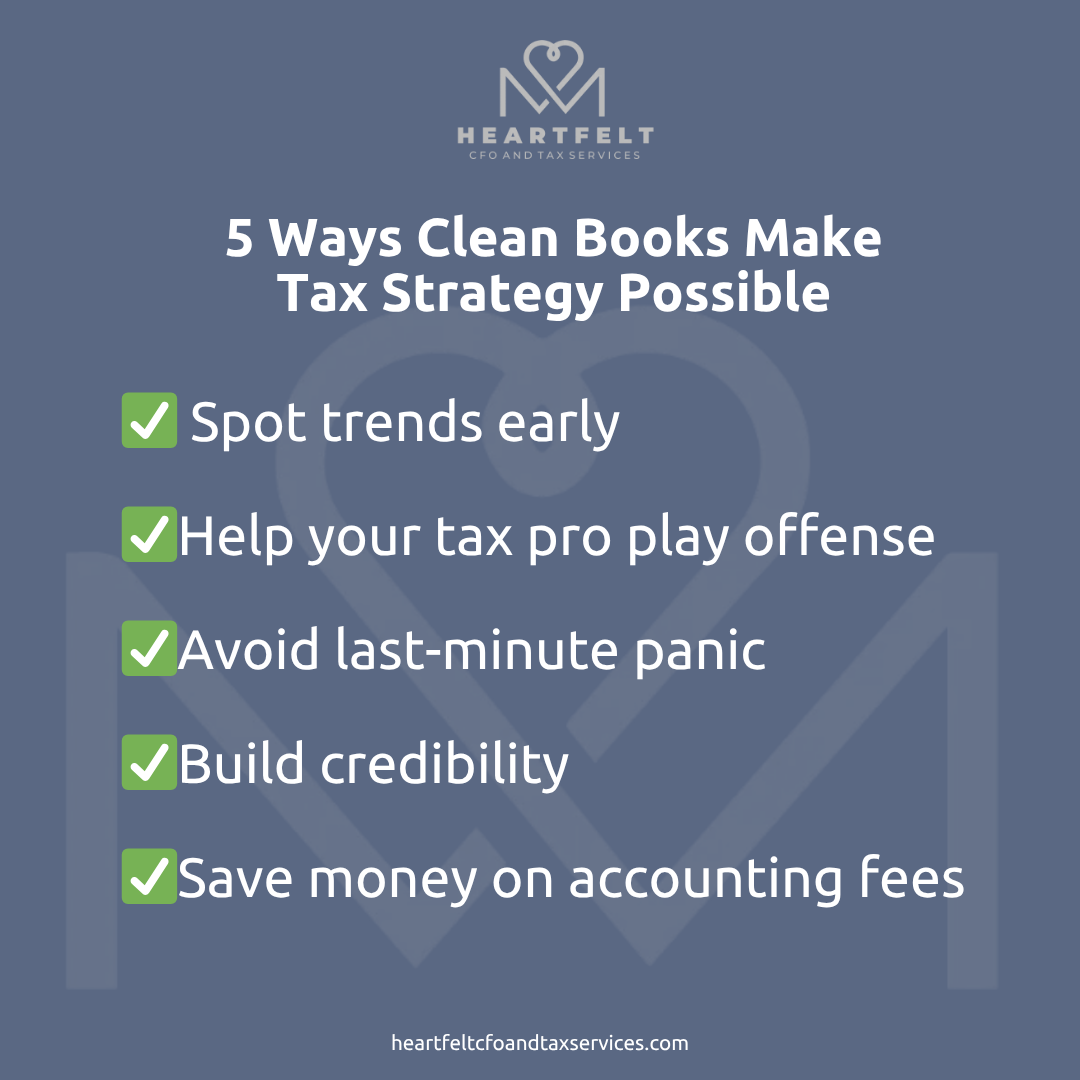

How Clean Books Unlock Real Tax Planning

When your bookkeeping is accurate and up to date, it’s not just about neat records—it’s about making tax strategy possible. Here’s why:

-

You spot trends earlier – Clean books let you see shifts in revenue or expenses before they become problems.

-

Your tax pro can play offense – We can proactively plan deductions, retirement contributions, and entity strategies instead of reacting to messy data.

-

You avoid last-minute panic – With reconciled accounts, you don’t scramble to find missing information in April.

-

You gain credibility – Whether it’s the IRS, a bank, or a business partner, clean books build trust in your numbers.

-

You save money – Every hour your tax professional spends cleaning your books is an hour they aren’t spending finding ways to save you money.

If you’ve ever heard Margo’s Bloomingdale’s story, you know how a simple misstep in categorizing expenses can lead to a completely different outcome on your tax return. And if you’ve got a Schedule C business, proper categorization is even more critical—it’s where many strategy wins (or losses) are decided.

The bottom line:

Tax planning doesn’t start with a stack of deduction receipts.

It starts with a crystal-clear financial picture—and that picture comes from your books.

If you want to learn how bookkeeping directly impacts your taxes, the Summit Masterclass breaks it down step-by-step. It’s designed to help small business owners and real estate investors understand the why behind their numbers—and what to do with them.

Ready to get proactive?

-

The Proactive Package gives you monthly bookkeeping and tax strategy in one place, so you’re always prepared: Learn more here

-

Online tools and courses—including the Summit Masterclass—walk you through how your books affect your taxes: Explore here

-

Or, book a supportive, judgment-free conversation with Margo to uncover your next best financial steps: Schedule your discovery call

Finances and taxes don’t have to be stressful—especially when your books are clean and working for you.